Content

The mutual lender’s Track Record product, a 100percent mortgage deal which launched last month, is a five-year fixed rate deal at 5.49percent. This rate will be available until 10pm on Thursday so borrowers need to act fast if they want to secure this deal. Swap rates are the interest rates at which the banks lend to each other, and are used by banks and building societies to price the fixed mortgage rates they offer their customers.

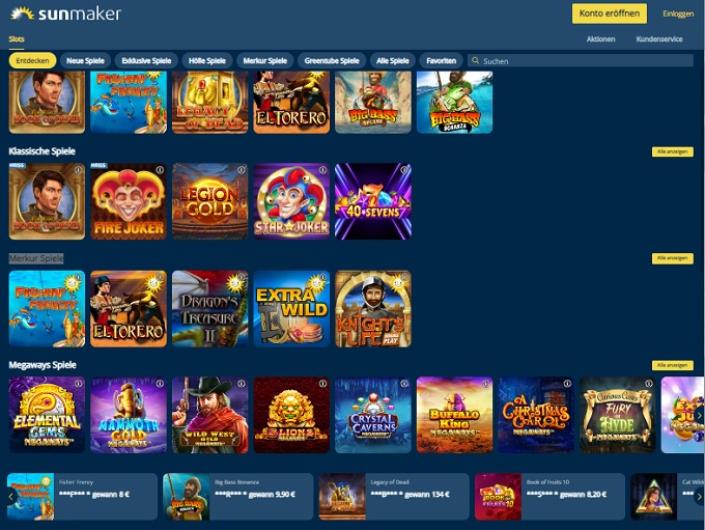

- By professional ethics, we are required to give unbiased recommendations and honest reviews about all online gambling sites we review.

- The five-year fixed rate let-to-buy deal is now at 4.59percent (75percent LTV) with a 3percent fee.

- Consult an attorney or tax professional regarding your specific situation.

- Neither Coventry’s or Nationwide’s members will be given a vote on their respective deals.

Over five-years Santander is offering a remortgage deal at 4.42percent (60percent loan to value) with a 999 fee. The mutual lender has reduced the cost of deals, available through brokers, for new customers and existing borrowers looking for a new rate. A number of smaller lenders, including the Hanley Economic, Principality, Saffron and Vernon building societies, have withdrawn selected mortgage deals at higher loan-to-value ratios, such as 90percent LTV and 95percent LTV.

How To Choose A 5 No Deposit Bonus Thats Right For You

Some online casinos will provide new customers with a straightforward no deposit bonus when you create an account. However, a no deposit bonus is more commonly bundled in with another offer, such as a deposit match bonus. There are also free spins for new and existing customers at certain online casinos. No deposit bonuses are not as common as deposit-based casino bonuses, and seldom as large. This is because the casinos are essentially letting you use a bonus without having to deposit any money. But even though it seems like there is no catch, keep in mind that no deposit bonuses usually do come with strings attached, including wagering requirements.

January: More Big Names Cut Rates

First-time buyer deals at 90percent loan to value will be pushed up by up to 0.11 percentage points. The five-year fixed rate for purchase will be at 4.59percent with a 995 fee and the two-year equivalent deal rises to 4.99percent. Clydesdale Bank has also given notice to brokers that it will increase selected residential fixed rates by up to 0.2 percentage points from 13 February.

Our team at CasinoAlpha rate this €3 no deposit bonus as highly recommended because it offers players 30 free spins to enjoy the 7Bit Casino slot collection. The wagering requirement of 45x is higher than the industry standard of 35x. However, it offers great happy-gambler.com read value to the player for a no investment bonus. We really appreciate the maximum cashout limit of €50 for a bonus with zero initial investment. Although the wagering requirements of 45x are higher than the standard, we still consider this Slot Vibe casino bonus to be recommended due to the fact that you have the chance to earn real money for free.

Best No Deposit Bonus Codes And Casinos July 2024

Each month, millions of players from across the globe trust us to connect them to online slots they’ll love. You can practice particular games such as slots or table games like blackjack and roulette without spending any money. Craps is one table game that brings to mind the glamor of the casino floor, but the online version also offers a lot.

January: Respite For Borrowers As Providers Start To Cut Fixed Rates

Aladdin Slots is offering new players a chance to play with 5 free spins on the Diamond Strike slot game without any deposit required. Look also at the follow-on rate, which is what the deal will revert to at the end of the term. That said, many homeowners look to remortgage to another rate once their initial fixed rate period ends.

Is It Possible To Play For Free And Win Real Money?

More than 367,000 mortgage holders will come to the end of cheap five-year fixed rate deals over the next 12 months, according to Equifax. It estimates the average borrower will now pay up to 1,400 a month on their mortgage – 40percent more than a year ago. Millions of borrowers on fixed rates could be facing ‘mortgage shock’ when they look for a new deal, and many could struggle to meet repayments, according to research by Equifax, writes Jo Thornhill. Swap rates, the interest rates at which the banks lend to each other and which they use to price fixed mortgage rates for customers, have spiked today and the market remains highly volatile.

Lenders are pulling their fixed and tracker rate offers at short notice to reprice higher as swap rates have risen rapidly ahead of an expected increase in the Bank of England Bank Rate next week.. HSBC and Nationwide have announced big increases to their fixed mortgage rates, piling more pain on beleaguered borrowers, writes Jo Thornhill. Aldermore is withdrawing its limited edition buy-to-let product at 6pm tomorrow . Brokers have been given notice to get all applications for this five-year fixed rate BTL deal in by this time.